Notice: Polkadot has migrated to AssetHub. Balances, data, referenda, and other on-chain activity has moved to AssetHub.Learn more

Polkadot Growth Index 📈 and AI Insights 💡

Hello Builders!

Intro

This proposal supports growth of Polkadot Relay & Parachains through on-chain growth insights about specific dApps and parachains, while increasing transparency for their teams & community.

The full discussion about the proposal and poll signals are available here. Initial poll signals:

Aye: 7 votes (100%)

Nay: 0 votes (0%)

The Challenge

The growth of the entire Polkadot ecosystem and individual parachains is related to dApps and wallet activity they bring into the ecosystem - users, TVL & fees.

Parachain teams currently lack a user-friendly growth tool that makes it easy to understand the condition of each of these metrics, which has been addressed several times by the community and W3F. In recent months, Tokenguard has conducted numerous interviews with Ecosystem & dApp builders:

"We would like to understand, from an aggregate (not individual) level, the activities our users do, and the patterns in their behavior. I.e. they may do regular token, defi, social or nft activity. We would also like to understand which on-chain activities are done manually vs automated using bots. Understanding the patterns can help us optimize the features of our software to streamline important use cases and provide a better user experience."

"We would like to understand new users. Where the users are coming from. How did the user fund their account. Correlation between users of different apps."

These and other answers revealed the problems and challenges of builders:

❌ lack of knowledge of user conversion, engagement & churns,

❌ lower TVL and funds inflow into the ecosystem,

❌ lack of tool displaying data suitable for social media promotion,

The Solution

Tokenguard proposes integration of three existing growth tools:

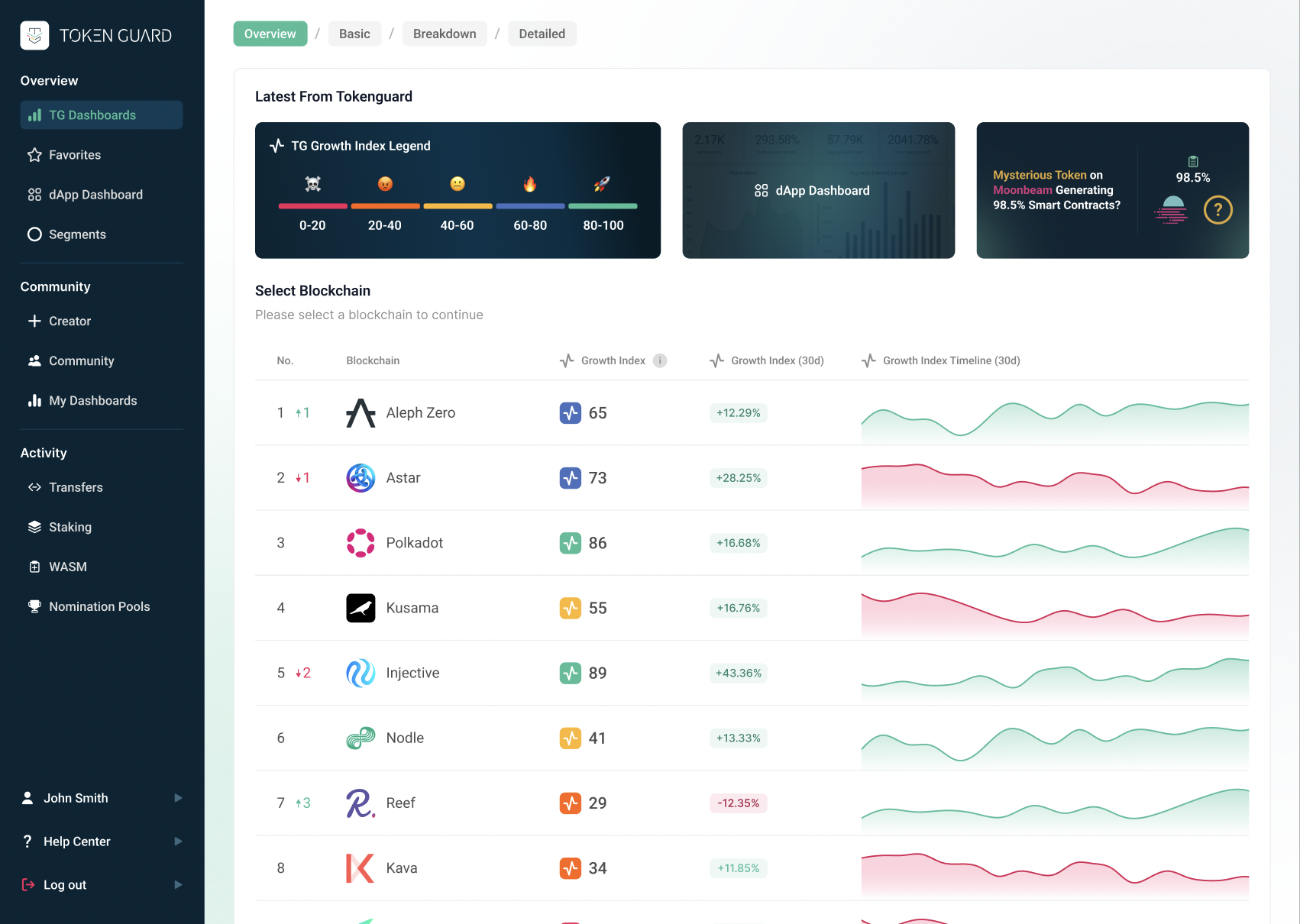

✅ Ecosystem Growth Index for the Polkadot & Kusama Relay chains and 3 parachains with Smart Contract functionalities - Moonbeam, Astar & Vara.

✅ dApp Growth Index for dApps deployed on the parachains.

✅ dApp AI Insights for dApp builders and community to understand the most important events within their products.

Presented solutions will provide insights into the growth of individual parachains and dApps, improving the acquisition of new users and funds, and offering valuable insights for enhancing the retention of existing users.

The solution is ideal for promotional purposes and attracting the attention of new users to the ecosystem and dApps.

We value your feedback and are looking forward to support the ecosystem 🔥

Comments (4)

Requested

Proposal Failed

Hello @Tokenguard,

Thank you for the proposal. Although I understand the necessity explained in the proposal and find the team well-suited for the solution, I must reject the proposal for the following reasons.

I find the requested amount reasonable, but I doubt the necessity of an additional data analysis effort when we have multiple teams working at this front.

Best regards,

kukabi | Helikon

Hey @🏔 HELIKON 🏔 !

Thank you for your comment and raising these important points. Our answers below:

We want to clarify that yes, the integration of data from other chains and dApps was facilitated by an external data provider upon request from a customer, who covered the costs in a private grant. Unfortunately, this data provider doesn't collect relay and parachain data and due to the fully decentralized nature of the Polkadot itself, this proposal is the only way to expand our support.

We acknowledge the importance of the integration of Dune as a milestone for covering the entire ecosystem with analytics. However, we'd like to emphasize that while Dune is a valuable tool, it serves a different purpose compared to Tokenguard:

💵 Financially-wise: Tokenguard will produce around 100 (dApps) x 52 (weeks) = 5200 data-related insights for dApp builders. Safely assuming 0.5-1h of a senior data analyst work every week with an hourly rate of $80h, this translates into $312 000 spent on analyzing the data, not including user insights or comparison features. This grant is ~50% of this value, around 20x less than Dune integration.

This proposal was created after discussions with multiple Substrate teams - including SubWallet, AZero.ID, Common DeX, Abax Finance, Nightly and others (can't share specific quotes here over privacy concerns). Dune is a wonderful tool but taking into consideration its size, we don't think it can answer very specific needs of Substrate dApp builders the way Tokenguard can.

Tokenguard uses SubSquid - a native & decentralized Polkadot project that is widely known, whereas Dune is a fully centralized entity. We believe that the Polkadot ecosystem should embrace diversity as monopolizing solutions could hinder progress and innovation.

Thank you once again for your feedback. We remain committed to the growth and development of the Polkadot ecosystem 🔥

Best regards,

Kamil | Tokenguard CEO

Hello - I wanted to provide some feedback on the proposal. It seems like the Tokenguard service is currently oriented towards a smart contract model, which you might find on ethereum, or a smart-contracts focused parachain like Moonbeam or a solochain. like Aleph Zero or Vara. I believe Polkadot to be structured differently, because the model of user interactions centers around not just smart contracts, but pallets, contracts and XCM across chains. Not to mention being architected as a relay chain, system chains, parachains and then application-specific chains/cores in the future, with the relay chain eventually becoming a chain with minimal features. I believe smart contracts will be important on various chains (e.g. pop, OpenEVM, etc.), but they do not seem to be the basis of activity today in Polkadot. For example, I believe the functionality frequently used on Polkadot today consists of opengov and staking on the relaychain, swapping/DCA on Hydra, LSDs on Acala/Bifrost, EVM/Swaps on Moonbeam, etc, as well as the XCM activities that help assets to flow around. I have not seen from the proposal that this activity is going to be tracked/measured by the development of the proposal, so it may not be measuring the growth of the ecosystem properly. If I am mistaken, could you list out the extrinsics that will be captured here beyond just smart contracts? Finally, as much as I appreciate what Vara is doing, as a solochain, I believe it is not a fit for funding by the Polkadot treasury for this particular purpose.

Hi @W1ZSPR3

Thank you for bringing up these important topics!

At the outset, we wanted to point out that each analytics tool serves a different purpose; it is impossible to use one tool to meet every need.

Tokenguard provides on-chain growth analytics focused on wallet conversion and behavior analysis. The aim of this proposal is to support ecosystem and builders where the traffic is highest, thus allowing to yield the greatest benefits due to ample data for analysis.

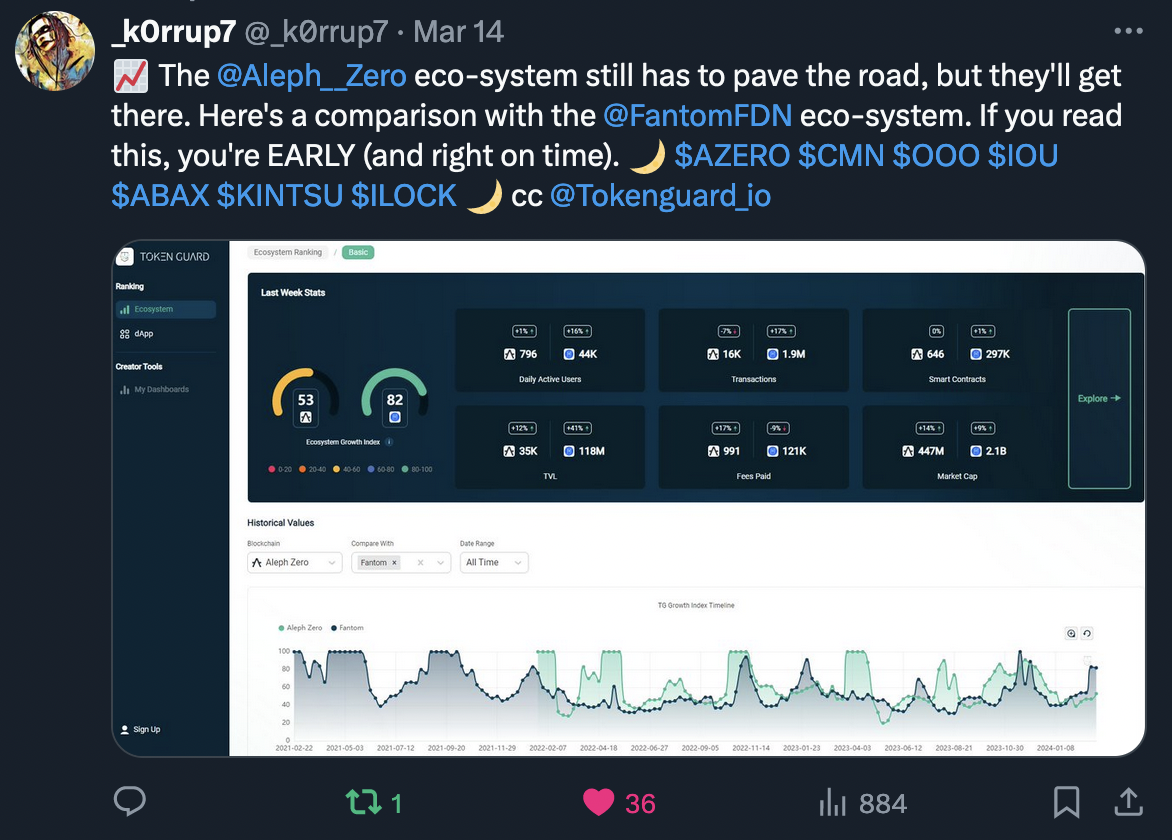

In the screenshot below, you'll find ecosystems with the highest user activity. Tokenguard proposes to cover the top 5 of these ecosystems.

Tokenguard delivers insights comparable to other ecosystems & dApps competitive to Polkadot. This allows to understand what type of dApps bring in most users into different ecosystems and how this translates into TVL / fees generated for the ecosystem.

Creating analytics for parachain-specific scenarios, where we deal with vastly different palettes and purposes of specific parachains is useful but would basically cover only a small % of the user traffic. Dune is being implemented into Polkadot to build analytics for this purpose.

Tokenguard supports XCMs the same wasy as Wormhole (https://app.tokenguard.io/wormhole/dapp-growth/) and other XC technologies.

Tokenguard supports all type of extrinsics and includes them into metrics (asset flow is included in TVL) - but for the sake of clarity we don’t display all of them as most of the traffic is generated by transfers, staking and dApps. Most ecosystem teams don't have time to analyze 0.1% of the traffic because bringing in 1 successful dApp is much more effective.

Thanks!

Kamil